In the UK, small companies must accept credit and debit cards. Whether you run a market stall, a café, or an online shop with a physical presence, having a reliable card reader ensures smooth transactions and better customer satisfaction. In 2025, the UK card payment landscape is dominated by versatile machines that cater to various business models.

This guide compares the top 10 card payment machines ideal for small business in the UK based on cost, connectivity, features, and support. From mobile card readers like SumUp and Square to countertop terminals like Tyl and Worldpay, we’ve covered options that suit every scale and type of business.

What are the best card payment machines for small business in 2025?

To select the best card payment machines for your small business in the UK, consider your transaction volume, business location, device portability, and your preference for pay-as-you-go or contract models.

Top criteria to consider:

- Hardware cost: One-off purchase vs monthly rental

- Transaction fees: Flat percentage or tiered by volume

- Connectivity: Wi-Fi, Bluetooth, 3G/4G, or Ethernet

- POS integration: Does it support inventory, reports, staff access?

- UK support: Availability of helpdesk, bank integration, or PCI compliance

Key selection factors:

- Low transaction fees for small margins

- Minimal or no upfront cost for new startups

- Wi-Fi or 4G support for remote selling

- Integration with mobile apps and accounting software

- Next-day fund settlement

- Security compliance: PCI-DSS & end-to-end encryption

Why should UK small businesses invest in card payment machines?

How do modern card terminals improve checkout speed and customer experience?

These days, contactless, chip and PIN, and mobile payments like Apple Pay and Google Pay are all supported by card readers. They reduce queue times, enhance customer satisfaction, and enable smooth digital receipts via email or SMS.

Most devices connect wirelessly, meaning less hardware and faster setup times. Tablets or smartphones can become full-featured POS systems when paired with these readers.

What are the cost-saving benefits over traditional PDQ machines?

Old-school PDQ terminals often come with long contracts, expensive maintenance fees, and limited compatibility.

Modern readers offer:

- No monthly contracts (e.g. Square Reader, SumUp Air)

- Simple flat-rate pricing

- Better connectivity options

- Easy mobile setup

Examples:

- SumUp: Pay-as-you-go, 1.69% fee, no rental costs

- Zettle: 1.75% fee, instant PayPal settlement

For small firms, these options provide greater flexibility and reduced operational expenses.

How much do card machines cost to run?

Hardware, transaction fees, and maintenance or service fees are all included in the cost of a card machine:

- Device cost: Mobile readers range from £19 to £89; countertop terminals can cost £199 or more, or be rented from £10/month.

- Transaction fees: Typically 1.5%–1.75%, depending on provider and volume.

- Compliance and extras: PCI-DSS fees (~£2–£5/month), setup or exit fees, and monthly service charges if on contract.

A pay-as-you-go model (like Square or Zettle) typically incurs no ongoing monthly fees, making it cheaper for low-volume traders.

Countertop Vs Portable Vs Mobile Card Readers

- The purpose of countertop card machines is to be utilised at specific checkout counters within your establishment. They don’t have any portability, but their connectivity is typically very dependable. They work well for companies like grocery stores and small retailers that have a set point of payment.

- Anywhere on your website, you may accept card payments using portable credit card machines, which are battery-operated gadgets that connect to Wi-Fi. They’re best for cafes and restaurants.

- Even more portable, mobile card readers run on batteries and accept card payments anywhere you are via a GPRS (3G or 4G) signal. Additionally, they typically have Wi-Fi capabilities. They work well for street food trucks, pop-up stores, marketplaces, festivals, and pretty much anywhere else.

Comparison by Reader Type

| Type | Device | Best For | Standout Feature |

| Mobile | Square Reader | Startups, market traders | Cheapest option, strong POS app |

| SumUp Air | Mobile businesses | Long battery life, pay-as-you-go fees | |

| Zettle Reader 2 | Security-conscious users | Transaction protection | |

| myPOS Go 2 | International traders | Instant payout, free IBAN | |

| Tide Card Reader | Small traders needing 4G | Free lifetime 4G, no contract | |

| Countertop | Square Terminal | Cafés, salons | All-in-one with built-in printer |

| Tyl by NatWest (Clover) | Larger businesses, retail | Built-in POS, bank integration | |

| Hybrid | Dojo Go | Hospitality, flexible venues | Offline mode, fast settlements |

| Worldpay DX8000 | Traditional shops | Robust with custom pricing plans |

Comparison Table of Card Payment Machines

| Device | Device Cost | Transaction Fee | CNP Fee | Connectivity | Key Highlight |

|---|---|---|---|---|---|

| SumUp Solo | £89 + VAT | 1.69% | 2.5% | 4G, Wi-Fi | Standalone with touchscreen |

| SumUp 3G | £109 + VAT | 1.69% | 2.5% | 3G | Fully independent, SIM enabled |

| Square Reader | £19 + VAT | 1.75% | 2.5% | Bluetooth | Compact, free POS app |

| Square Terminal | £199 + VAT | 1.75% | 2.5% | Wi-Fi | All-in-one with built-in printer |

| Zettle Reader 2 | £29 + VAT | 1.75% | 2.5% | Bluetooth | High security, PayPal integration |

| myPOS Go 2 | £39 + VAT | 1.10% + 7p | 1.3% + 15p | 4G, Wi-Fi | Instant payout, international ready |

| Tide Card Reader | £19.99 + VAT | 1.5% | TBC | 4G | Lifetime free 4G, no monthly fees |

| Barclaycard Smartpay | £29 + VAT | 1.6% | N/A | Bluetooth, App | Bank-backed, real-time dashboard |

| Tyl by NatWest (Clover) | £16.99 + VAT/month | 1.39%–1.99% + 5p | N/A | 4G, Wi-Fi | Built-in POS & CRM features |

| Worldpay DX8000 | £15/month (£1 for 12m) | Custom / 1.5% Simplicity | Varies | Wi-Fi, Mobile | Full-size terminal with receipt printing |

1. SumUp Solo

Device cost: £89 + VAT

Transaction fee: 1.69%

CNP fee: 2.5%

Key features:

- Standalone device with touchscreen

- Optional printer and charging station

- Built-in 4G and Wi-Fi connectivity

- Accepts Google Pay, Apple Pay, contactless, and chip and PIN.

- One-day payment settlement

SumUp Solo is a highly compact, self-contained card reader that doesn’t require a smartphone or tablet to operate. With its intuitive touchscreen and optional receipt printer, it’s ideal for sole traders and mobile businesses who want a no-fuss payment solution. Weighing less than many smartphones and offering built-in 4G connectivity, it’s perfect for pop-up shops, stalls, and events.

While the battery is sufficient for a full day’s trading, the added dock ensures a full charge and stable positioning. It excels in portability and ease of use, though some users have noted occasional issues with the touchscreen’s responsiveness. Solo settles transactions the next business day, making cash flow easy to manage.

A great fit for independent traders who value simplicity and function in one device.

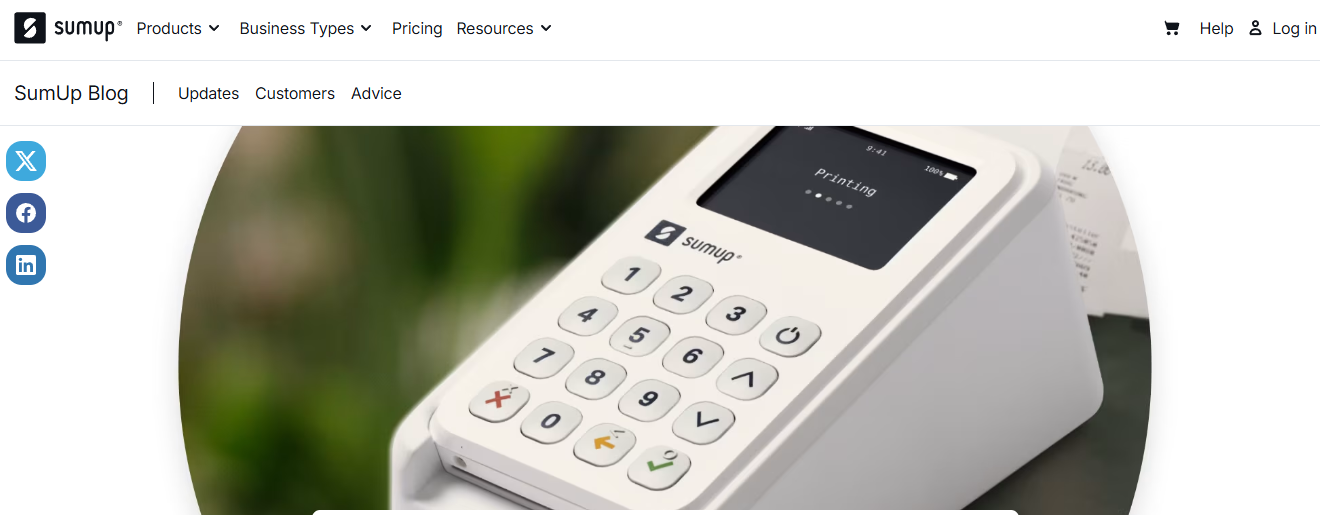

2. SumUp 3G Card Reader

Device cost: £109 + VAT

Transaction fee: 1.69%

CNP fee: 2.5%

Key features:

- 3G card reader with built-in SIM

- Standalone (no phone needed)

- Accepts contactless, chip & PIN

- Ideal for areas without Wi-Fi

- Optional receipt printer available

SumUp 3G is designed for traders who work in remote areas or outdoor markets where Wi-Fi or smartphone pairing isn’t practical. With its built-in SIM and 3G connectivity, it processes payments independently. It’s slightly bulkier than the SumUp Solo but remains highly portable.

The simplicity of use makes it popular among taxi drivers, delivery services, and outdoor vendors. Though it lacks some of the enhanced interface features of newer models, it shines in reliability and flexibility. There are no monthly fees, and payments are deposited the following day.

Perfect for mobile businesses needing a network-independent solution.

3. Square Reader

Device cost: £19 + VAT

Transaction fee: 1.75%

CNP fee: 2.5%

Key features:

- Compact and lightweight (56g)

- All-day battery life

- Bluetooth connection to smartphone

- Accepts Google Pay, Apple Pay, contactless, and chip and PIN.

- Free Square POS app

One of the most accessible and reasonably priced card readers available in the UK is Square Reader. Its sleek design and small footprint make it a favourite for small business owners. Simply pair it via Bluetooth with your smartphone and start taking payments through Square’s app.

The app is a standout feature, offering a comprehensive POS system for retail, hospitality, and personal services like salons. Funds settle the next working day. Businesses processing over £200,000 annually can access reduced transaction fees.

Ideal for startups, pop-ups, and service providers wanting a minimal upfront investment.

4. Square Terminal

Device cost: £199 + VAT

Transaction fee: 1.75%

CNP fee: 2.5%

Key features:

- All-in-one terminal with touchscreen

- Built-in receipt printer

- No smartphone needed

- Accepts all major payment types

- Battery lasts a full trading day

The Square Terminal is an excellent upgrade from the Square Reader for businesses that want a self-contained POS solution. With a sleek design, it combines card acceptance, receipt printing, and business reporting in one device.

It’s more expensive upfront but ideal for cafés, boutiques, or salons with fixed payment stations. Transactions are seamless and fast, and the integrated POS tools simplify inventory and sales tracking.

Great for businesses scaling up from mobile solutions to full-service terminals.

5. Zettle Reader 2 (by PayPal)

Device cost: £29 + VAT

Transaction fee: 1.75%

CNP fee: 2.5%

Key features:

- Lightweight (130g) with keypad

- Accepts contactless, chip & PIN, and all major payment methods

- 8-hour battery life (100 transactions)

- Pair with iOS/Android via Bluetooth

- Integrated with PayPal Business

Zettle Reader 2 is renowned for its user-friendliness and security. The device is tamper-resistant and meets high encryption standards. Users benefit from PayPal’s transaction protection and near-instant access to funds through PayPal accounts.

Its app is user-friendly and offers real-time insights. While battery life isn’t as long as some competitors, it handles short trading days or appointments with ease.

Recommended for freelancers and microbusinesses who already use PayPal or want robust fraud protection.

6. myPOS Go 2

Device cost: £39 + VAT

Transaction fee: 1.10% + 7p (Amex 2.45% + 7p)

CNP fee: 1.3% + 15p (Amex 2.5% + 15p)

Key features:

- Instant access to funds with no added fees

- Accepts a wide range of payment types including JCB, UnionPay

- Free e-money merchant account with multi-currency IBAN

- Compact design with tactile keyboard

- SMS/email receipts and printer compatibility

myPOS Go 2 is designed for business owners needing quick access to payments and international capabilities. With built-in 4G/Wi-Fi and a simple Linux OS, it’s intuitive, functional, and powerful.

It offers fast fund settlement and includes a free VISA business card linked to your merchant account. The device supports detailed transaction tracking and multi-operator modes to split tips and manage staff performance.

This reader is ideal for freelancers and SMEs operating internationally or in cash-flow-sensitive environments.

7. Tide Card Reader

Device cost: £19.99 + VAT (Card Reader Plus: £29.99)

Transaction fee: 1.5%

CNP fee: TBC

Key features:

- Free lifetime 4G connectivity

- No monthly fees or contracts

- Accepts contactless, chip & PIN, digital wallets

- Sleek, mobile-ready build

Tide Card Reader offers incredible value and flexibility for startups and microbusinesses. This standalone reader comes pre-loaded with unlimited 4G data—ideal for business owners without reliable Wi-Fi access.

It integrates with Tide’s business banking and allows you to take payments on the go or in-store. You don’t need a separate merchant account setup, making onboarding easier for new businesses.

For new businesses and sole proprietors seeking quick, contract-free access to payments, Tide is ideal.

8. Barclaycard Smartpay Anywhere

Device cost: £29 + VAT

Transaction fee: 1.6% (custom plans available)

CNP fee: N/A

Key features:

- Accepts all major card types and wallets

- Payouts next working day (before 7 PM)

- Web dashboard and app with real-time reporting

- Free FreshBooks account

- PCI compliant with 24/7 support

The Barclaycard Smartpay Anywhere gadget, designed for retail and hospitality, is supported by one of the biggest banks in the UK. The app-based setup transforms your smartphone into a full-featured POS system with support for reporting, sales tracking, and receipt delivery.

While approval requires a vetting process, it ensures you get a system suited to your trading profile. The competitive flat-rate pricing and streamlined user experience make it a solid pick for small merchants.

9. Tyl by NatWest (Clover Flex)

Device cost: £16.99 + VAT/month

Transaction fee: 1.39%–1.99% + 5p (based on volume)

CNP fee: N/A

Key features:

- Built-in POS, inventory, CRM, and receipt printing

- Wi-Fi + 4G enabled

- Accepts all major payments

- 8-hour battery, 5-inch touchscreen

- 150+ business apps via Clover Marketplace

Tyl’s Clover Flex is a powerful all-in-one card reader and POS system suited for businesses with higher transaction volumes. It offers rich features such as inventory tracking, real-time analytics, CRM, and a suite of custom apps.

While it’s heavier than some portable options, the benefits outweigh the size for established businesses. Tyl is perfect for retail stores and busy locations since it offers customised service and same-day payments.

10. Worldpay DX8000

Device cost: £15/month (intro: £1 for 12 months, 18-month contract)

Transaction fee: Custom or Simplicity Tariff (1.5%)

CNP fee: Varies

Key features:

- Dual-band Wi-Fi and mobile connectivity

- Built-in receipt printer and touchscreen

- Accepts all major payment cards

- Integrated with Worldpay Dashboard

- Next-day terminal replacement service

A trustworthy option for in-person and mobile payments is the Worldpay DX8000. With advanced connectivity and a responsive touchscreen, it streamlines transactions and improves service.

It suits businesses with larger turnover due to its flexible pricing options. Its terminal replacement promise ensures uninterrupted operation—great for reliability-focused retailers.

An ideal choice for growing SMEs wanting scalable, supported payment infrastructure.

Which mobile card readers are ideal for UK startups and market traders?

What makes the Square Reader a top pick?

The Square Reader is lightweight, low-cost, and pairs via Bluetooth with your mobile device. It supports contactless and chip & PIN payments and includes a free POS app.

According to a UK café owner:

“We started with Square and never looked back. Easy setup and real-time tracking made our launch stress-free.”

It integrates well with many POS systems and has offline functionality for use in areas with poor Wi-Fi.

How does SumUp Air compare in cost and battery life?

SumUp Air is affordable at £34, with 500 transactions per charge. It supports subscriptions (0.99% fee) and pay-as-you-go (1.69%) models.

With day-long battery life and reliable Bluetooth connection, it’s ideal for stalls and mobile vendors.

Is Zettle Reader 2 right for security-conscious SMEs?

Yes. Zettle Reader 2 complies with the highest encryption standards. For up to £250 per month, it offers transaction protection and is impervious to tampering. Great for users who value data integrity and secure settlement.

Which card reader is best in the UK?

Top-rated UK card readers for 2025:

- Square Reader: Best for new companies because it’s quick to set up and has a cheap entrance fee.

- Zettle Reader 2: Excellent for PayPal users and chargeback protection.

- myPOS Go 2: Great for international or mobile businesses.

- Dojo Go: Best for speed and hospitality venues.

- Tyl by NatWest: Ideal for scaling with POS and bank integration.

Conclusion

Selecting a card payment machine depends on your business type, budget, and mobility needs. Mobile readers offer flexibility and affordability, while countertop systems provide advanced POS functions. Consider total cost of ownership, transaction fees, connectivity, and UK-based support when making your choice.

FAQs about 10 Card Payment Machines Ideal for Small Business in 2025

How much does it cost to run a card machine?

Running costs vary from £0 (with pay-as-you-go readers) to £30/month for rental terminals, plus transaction and compliance fees.

What is the cheapest card reader in the UK?

Square and Zettle readers cost between £19 and £29 with no monthly fees and a flat transaction rate.

Is it better to buy or rent a card machine?

Buying is best for cost savings over time. Renting suits businesses needing regular support and maintenance.

Are there free card readers available?

No completely free devices, but many providers offer low-cost, contract-free options with full functionality.

Can I charge customers for card fees?

No—UK law prohibits passing processing fees to customers. These must be absorbed by the business.

I’m Adam Milne, a business writer and co-author at UKBusinessMag.co.uk. I’m passionate about simplifying complex topics—whether it’s tax, startup strategy, or digital marketing—so that entrepreneurs can take action with confidence. With years of experience in small business consultancy, I bring a practical perspective to every piece I write, helping readers turn ideas into results.