If you’ve been contributing to the NHS Pension Scheme for 20 years, you’re likely curious about how much pension income you’ll receive at retirement. As a public sector defined benefit pension, the NHS scheme offers security, inflation protection, and several flexible options for retirement. This comprehensive guide will help you understand how much pension to expect after 20 years, how your scheme type affects your benefits, and what steps you can take to enhance your retirement income.

“The NHS Pension Scheme remains one of the most secure and generous defined benefit pensions in the UK.” – Tom Selby, Head of Retirement Policy, AJ Bell

What Is the NHS Pension Scheme and Who Runs It?

The NHS Pension Scheme is a defined benefit occupational pension plan administered by the NHS Business Services Authority (NHSBSA). It provides retirement income based on your pensionable earnings and years of service. The scheme is split into three main sections:

- 1995 Section: Final pay, automatic lump amount, and retirement age of 60.

- 2008 Section: Final pay, optional lump amount, and retirement age of 65.

- 2015 CARE Scheme: Retirement age and career average are related to the State Pension Age.

What Scheme Will Affect Your 20-Year NHS Pension?

How Much NHS Pension Will I Get After 20 Years?

The amount depends on your scheme and salary. Here’s a breakdown:

1995 Final Salary Scheme

- Accrual Rate: 1/80 per year of service.

- Pension after 20 years: 20/80 × final salary.

- For Example: £60,000 salary → £15,000 annual pension + £45,000 one-time payment.

2008 Final Salary Scheme

- Accrual Rate: 1/60 per year.

- Pension after 20 years: 20/60 × final salary.

- Example: £60,000 salary → £20,000/year (lump sum optional).

2015 CARE Scheme

- 1/54 of annual pensionable earnings is the accrual rate.

- The accrual is revalued every year using CPI + 1.5%.

- For example, before revaluation, the average wage of £60,000 × 20/54 equals around £22,200.

“Even after 20 years, the NHS Pension can offer income security unmatched by most private pensions.” – Steve Webb, Former Pensions Minister

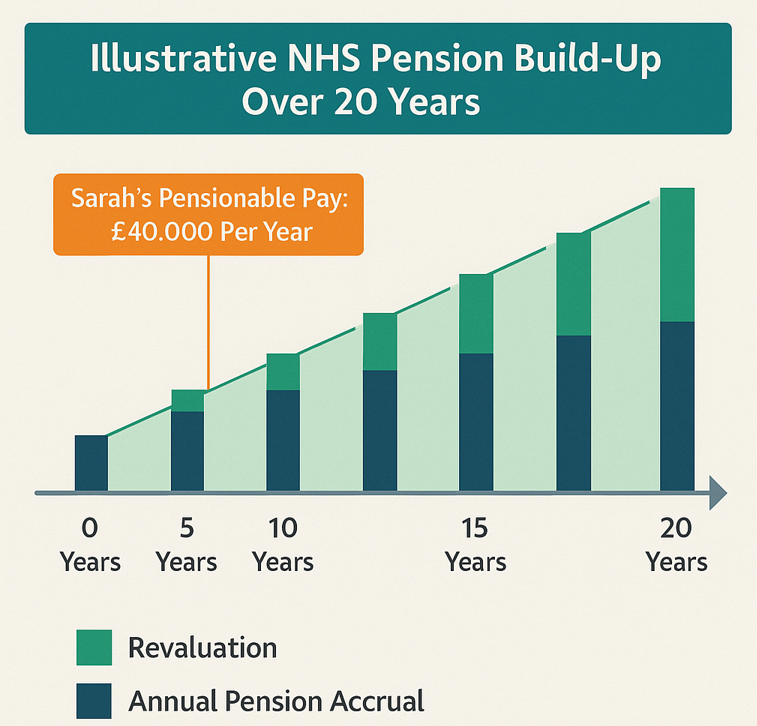

How Is Your 20-Year Pension Calculated in the 2015 CARE Scheme?

| Feature | 2015 CARE Scheme |

|---|---|

| Type | Career Average Revalued Earnings (CARE) |

| Accrual Rate | 1/54th of pensionable earnings per year |

| Revaluation Method | CPI + 1.5% added annually to each year’s pot |

| Normal Pension Age | Linked to State Pension Age (e.g., 67 or 68) |

| Lump Sum | Not automatic (can be taken by exchanging pension) |

| Calculation Example | Earn £40,000/year → £740.74/year added to pension pot |

| Total After 20 Years | Approx. £14,800–£18,000/year (depends on salary growth and inflation revaluation) |

🔍 Example:

If you earn £40,000 consistently:

-

Yearly accrual: £40,000 ÷ 54 = £740.74

-

Revalued yearly by CPI + 1.5%

-

After 20 years, with revaluation, you’ll likely have £15k–£18k annual pension from this scheme alone.

Is it better to be in the 1995 final salary scheme or the CARE 2015 scheme?

- 1995 Scheme benefits those with high earnings at retirement.

- CARE Scheme rewards consistent salary over time.

- The McCloud remedy gives eligible members a choice for service between 2015–2022.

Factors to consider:

- Retirement age preferences.

- Salary trajectory.

- Desire for lump sum (1995 contains 3x lump sum automatically).

Which NHS pension scheme applies to your service?

It depends on when you joined the NHS and if you’ve moved schemes:

| Join Date / Circumstance | Scheme You’re Likely In |

|---|---|

| Before 1 April 2008 | 1995 Final Salary Scheme |

| Between 1 April 2008 and 31 March 2015 | 2008 Final Salary Scheme |

| From 1 April 2015 onwards | 2015 CARE Scheme |

| If you had protection (pre-2012 joiner) | May have stayed in 1995/2008 until 2022 |

| After 1 April 2022 | Everyone is now in the 2015 CARE Scheme |

How does McCloud remedy affect your pension choices?

The McCloud judgment ensures those affected by the 2015 reforms receive fair treatment. Staff can choose between legacy and reformed schemes for service between 2015 and 2022. This could significantly affect your final benefits. Ensure your service record and Annual Benefit Statement reflect accurate scheme membership across those years.

Which scheme benefits you more?

The final salary schemes benefit those with high salaries at the end of their career. Those with earlier career peaks or a continuous income growth may be given preference under the CARE program. Consider your individual earnings history and planned retirement age when assessing scheme value.

What Pension Might You Receive After 20 Years?

- Basic Example:

At a consistent salary of £60,000, CARE scheme will accumulate 20 × (£60,000 ÷ 54) = £22,200 before revaluation. With annual CPI + 1.5%, this amount could be significantly higher at retirement. - Revalued Example:

If the CPI + 1.5% revaluation averages 3% yearly, early accruals grow considerably. The final pension might exceed £25,000/year. Inflation rates and wage development will determine the actual results. - Final Salary Comparison:

- 1995 Scheme: £60,000 × 20/80 = £15,000

- 2008 Scheme: £60,000 × 20/60 = £20,000 CARE pension may exceed these figures if salary growth is consistent and early accruals benefit from inflation.

- Other influencing factors:

Changes in working hours, part-time status, or breaks in service can impact the total accrued pension. Also, extra responsibilities or clinical excellence awards can boost pensionable pay.

“NHS staff may underestimate the value of their pension. Even a 20-year career can produce an excellent base for retirement.” – Becky O’Connor, Director of Public Affairs, PensionBee

How Does Final Salary (1995/2008) Compare After 20 Years?

| Feature | 1995 Scheme | 2008 Scheme |

|---|---|---|

| Type | Final salary | Final salary |

| Accrual Rate | 1/80th pension + 3/80th lump sum | 1/60th pension (no automatic lump sum) |

| Normal Pension Age | 60 | 65 |

| Lump Sum | Automatic (3x pension) | Optional (via pension exchange) |

| Best Pay Used | Best of last 3 years | Average of best 3 consecutive years in last 10 |

| Pension After 20 Years | £10,000 annually (25% of £40,000) | £13,333 annually (33.3% of £40,000) |

| Lump Sum (if taken) | £30,000 (3x £10,000) | Optional, e.g. £20,000 lump sum for £3,333 less/year |

| Total Annual + Lump (Yr 1) | £40,000 total value in first year | £33,333–£46,666 depending on lump sum choice |

| Flexibility | Fixed structure (age 60, automatic lump sum) | More flexible (commutation, later retirement) |

💡 Note: These are illustrative figures—actual pension depends on salary history, part-time status, and pensionable service rules.

How Good Is the NHS Pension?

The NHS pension is widely regarded as one of the best defined benefit schemes in the UK public sector:

- Guaranteed income for life after retirement.

- Backed by HM Treasury, ensuring security.

- Indexed annually to inflation (CPI), protecting real income.

- Includes death-in-service benefits and survivor pensions.

- Partial retirement flexibility: draw part of your pension while continuing work.

“A defined benefit pension like the NHS scheme offers financial security that’s hard to replicate in the private sector.” – Ros Altmann, Former UK Pensions Minister

How is the NHS pension revalued each year?

Under the 2015 CARE Scheme:

- Up until retirement, your annual pension accrual is revalued using CPI + 1.5%.

- After retirement, your pension is increased annually in line with CPI.

This ensures that pensions retain their real-world purchasing power, even years after you leave the workforce.

How much can I take as a tax-free lump sum?

-

1995 NHS Pension Scheme: Provides a tax-free lump sum automatically, equal to three times your annual pension amount.

-

2008 and 2015 Schemes: Allow you to give up part of your pension in exchange for a lump sum, with £12 received for every £1 of annual pension surrendered.

-

HMRC Tax-Free Rule: You can usually take up to 25% of your total pension benefits as a tax-free lump sum.

Lump sum considerations:

- Helpful for clearing debt or funding retirement projects.

- Reduces your annual pension income.

Can I get an estimate of my NHS pension online?

Yes, you can:

- Log into the NHSBSA Member Hub.

- View or download your Annual Benefit Statement.

- Use the online calculators for early retirement, lump sum options, and added pension projections.

Estimates reflect projected pension value under current earnings and contribution status.

Can I take my NHS pension early?

Yes, you can take benefits from age 55, but:

- If a pension is accepted before the Normal Pension Age, it will be actuarially decreased.

- Partial retirement is available with reduced hours and continued accrual.

- You may draw 20–100% of your pension and still work.

Speak to your HR team or contact NHSBSA for formal quotations.

Is It Worth Putting a Lump Sum Into Your NHS Pension?

- Tax Efficiency: Contributions attract tax relief.

- Boost Lifetime Income: Can purchase added pension.

- Planning Flexibility: Ideal for managing windfalls, bonuses, or legacy savings.

- Limitations: Stay within Annual and Lifetime Allowances.

What Options Exist to Boost Your Pension?

- Additional Voluntary Contributions (AVCs): Build a separate retirement pot.

- Added Pension: Purchase an additional pension by monthly contributions or a lump amount.

- Work Longer: Postponing retirement boosts your annual income.

- Partial Retirement: Continue accruing while drawing pension.

- Pension Recycle: Retire and rejoin on part-time hours to earn and draw pension.

How Much Total Retirement Income Could You Have?

- NHS Pension: £20,000–£30,000/year after 20 years.

- State Pension: Up to £11,502/year (2025).

- AVCs/Other Savings: May increase your retirement pot further.

Estimated Example

| Income Source | Amount (Annual) |

|---|---|

| NHS Pension (CARE) | £25,000 |

| State Pension | £11,502 |

| AVCs & Investments | £5,000 |

| Total Income | £41,502 |

Conclusion

How Much NHS Pension will I Get after 20 years? After 20 years in the NHS, your pension can offer you a financially secure retirement—especially when paired with the State Pension and additional contributions. By understanding your scheme, planning for tax efficiency, and using tools like AVCs or Added Pension, you can significantly enhance your financial future.

“Pensions are not just about the end of your career—they’re a critical part of your long-term financial wellbeing.” – Becky O’Connor, PensionBee

FAQs about How Much NHS Pension will I Get after 20 years?

How can I find out which scheme I’m in?

Check your Annual Benefit Statement in the NHSBSA Member Hub or ESR portal. Your previous and current scheme memberships will be listed.

What if I miss my McCloud remedy statement?

Contact NHSBSA promptly. This could impact how your 2015–2022 service is valued.

Can salary increases raise my pension?

Yes. In the CARE scheme, each year’s pension is based on your pensionable earnings, so promotions and salary growth directly impact accruals.

Is partial retirement worthwhile?

Absolutely. It allows you to draw pension income while working reduced hours, maintaining NHS benefits and continued accrual.

Related Posts:

- NHS Pension Scheme April 2025 Changes

- How Much Pension Pot Do I Need for £2000 Per Month?

- How to Avoid Paying Tax on Your Pension

I’m Laura Wilson, a passionate blogger and content creator with a deep interest in business, finance, and entrepreneurship. I’ve had the opportunity to write for several premium blogs, sharing insights & practical advice for individuals & small businesses. I’m the founder and publisher of ukbusinessmag.co.uk, where I focus on creating valuable, easy-to-understand content to help UK startups & SMEs grow.