The internet is here in the UK, and it opens up many things that can be bought online. It is really amazing; anything you want can get found. Now, to actually grab all this cool stuff, people need to pay! It takes some serious thought, and folks in the UK use some really cool digital payment methods. So, let’s check out some of the most liked payment types. It turns people’s online dreams into a reality; there’s a lot to learn about.

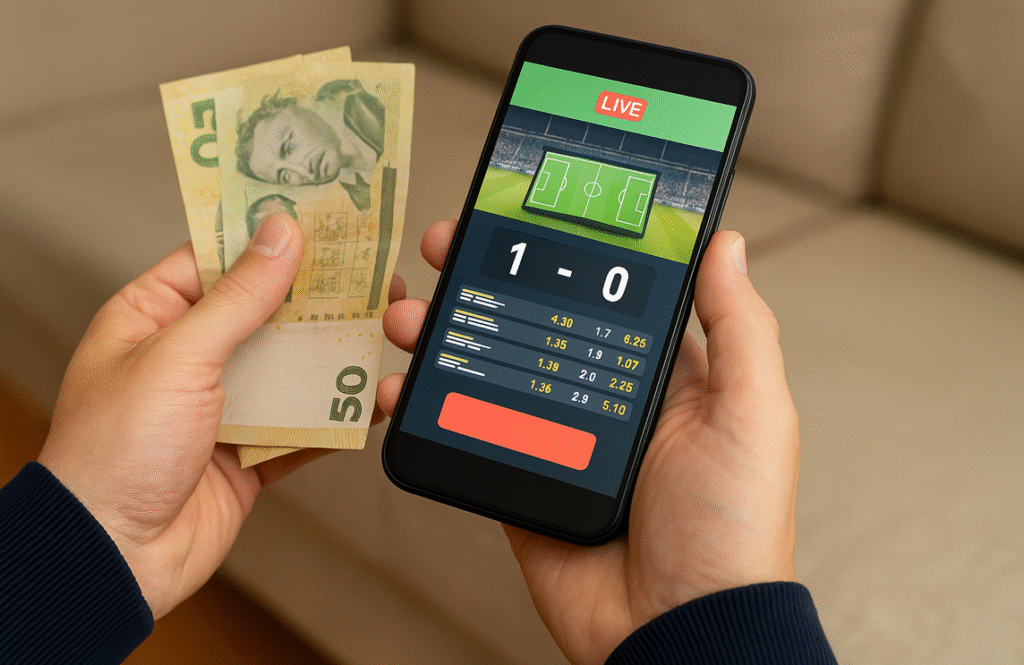

Online Gambling and Payment Options

For those interested in placing a wager, it’s good to understand the options available for quick access to your winnings. Instant Withdrawal Betting Sites offer a convenient and efficient way to manage your funds. Whether you prefer e-wallets, debit cards, or bank transfers, many online platforms provide options for fast and secure transactions. Also, there are many promos that one can take, because they have no maximum transaction volume for deposits/withdrawals . But gambling should always be responsibly! Do not spend a whole lot on the chance thing! Spending money to gamble needs thinking about carefully to not lead with worries in the future. Keep in mind to enjoy it, or just walk away and it’s fine.

With many cool payment options now, one just needs to think on a couple points before choosing them. Security is most important always! Read reviews, to see the payment options that have encryption plans. The ease is key because no one loves to use stuff that is complex. Most people would love the payment option that runs smoothly with zero waits. Also please think on costs because one does not want to get charged with extra. Check to see if hidden stuff appears like high fees and so on, and compare many choices to see which one fits with you!

Debit and Credit Cards Still Reign

Good old debit and credit cards never go away. Visa and Mastercard; they’re everywhere. Almost all UK online stores take them, so its is really important. They feel easy, they know that debit and credit cards are easy to use and that they are secure. As card-using continues, vendors are finding ways to encrypt card details in order not to lose the clients money with theft.

Most banks have this now. Card payments also offer protection; if something happens, you can always call your bank for them to reverse charges. So that always feels good, like one has a back up plan. So, they will always have an iconic spot in the UK.

PayPal’s Continued Popularity

Another giant in online payments is PayPal. In today’s high security environment Paypal offers users money safekeeping in a secured digital wallet. Many businesses and firms have an option to “Check out with Paypal” — but why? Because the users’ card details are safe. You don’t give all your card info, it is super simple to do! One just needs their email and password. That’s why more than 25 million users in the UK use it often; one feels really, really secured.

If one does not trust cards, well, now direct bank transfers is for you! It is on the rise in the UK. It is easy; payment goes straight from bank account to website, which many love. Open Banking makes this even easier; this makes it easy, fast, and very safe between bank and vendor accounts. This makes it less important to keep on sharing card details, as it creates very little stress over digital theft. It is very safe too, as the whole process takes place in a bank’s network.

Mobile Payments Are Very Common

With phones getting better, mobile payments are great for UK, where the phones run the show. Services like Apple Pay and Google Pay mean people can pay with a touch. You can make fast, simple and secured payments using your phones only. All it takes is one quick scan during the transaction. It is very amazing!

Security is super tight: either face, fingerprint, or passcode to authorize every payment made. All you have to do is add valid card info. Phones are so cool to use to buy everything from clothing, food, to even cinema tickets!

Buy Now, Pay Later Emerges

A recent trend in the UK is Buy Now, Pay Later (BNPL). Klarna and Clearpay let you split the cost of an item into many payments. This is great and fun, if you need that sweater but cash is little! These payment types have caught people’s hearts, that allow one make purchases at one now, then payment later.

Because online shopping can go fast, BNPL really creates people feel at ease about money, as now you are not worried you’re spending a whole bunch just to feel like there’s money! BNPL is great. Pay now, and feel great with your new shopping.

Cryptocurrency’s Future Potentional

While not for every person like the card and all, Cryptocurrency is growing in UK for online gambling. Although not all places accept like the debit cards, crypto are showing chances to be payment methods used by more people. As UK embraces digital items, more places may adopt crypto.

Being new, the cryptos keep on improving to being safer. What is interesting with crypto currency is that anyone can start an enterprise with little start up funds. The world is truly on the way to a technological advancement with payment methods, and now UK has become the focus!

Conclusion

UK is really at the heart of online payments. Cards, to wallets, to cryptos, it does have something for anyone! As web stores continue to transform, expect many payment choices which means only faster payments! Remember, payment choices are key as it means zero stress, as it guarantees you can easily pay it all, anywhere.

I’m Laura Wilson, a passionate blogger and content creator with a deep interest in business, finance, and entrepreneurship. I’ve had the opportunity to write for several premium blogs, sharing insights & practical advice for individuals & small businesses. I’m the founder and publisher of ukbusinessmag.co.uk, where I focus on creating valuable, easy-to-understand content to help UK startups & SMEs grow.