Introduction

Many people in the UK depend on Universal Credit for financial support, yet few fully understand how their savings can impact their entitlement. This lack of clarity can lead to unexpected reductions or even losing eligibility.

In this guide, you’ll learn the exact rules of the Universal Credit savings limit, how it’s calculated, what counts towards it, and the exceptions that might apply to you.

Keep reading to see a step-by-step breakdown, examples, and tools to check your eligibility — so you can plan your finances with confidence.

What is the Universal Credit savings limit and how does it work?

What are the £6,000 and £16,000 capital thresholds?

Universal Credit is a means-tested benefit. That means the Department for Work and Pensions (DWP) looks at your savings and other capital to decide how much you’ll get.

-

£0 – £6,000: Your savings won’t affect your payment.

-

£6,000 – £16,000: Your payment will be reduced.

-

Over £16,000: You will normally be ineligible for Universal Credit.

How is the capital limit applied in practice?

The DWP looks at your total capital balance each month on your UC assessment date. They count:

-

All personal savings in banks, building societies, or cash.

-

The value of investments like shares and ISAs.

-

Certain lump sums like redundancy payments or inheritance.

If your balance fluctuates during the month, they still base their calculation on the balance on that specific date. This means one-off deposits (like a bonus) can impact your UC for at least one month.

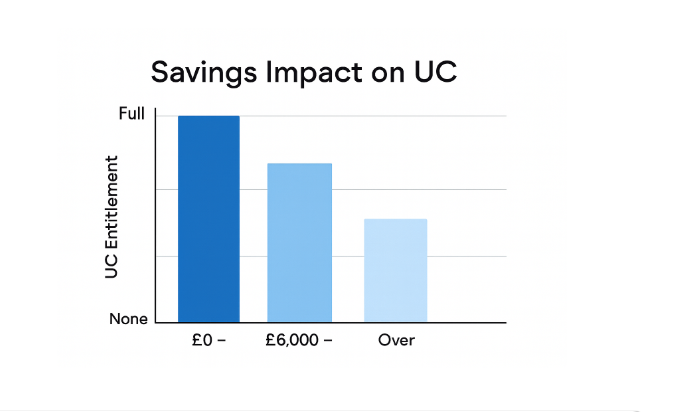

Savings Impact Table:

| Savings | Impact on UC |

|---|---|

| £0 – £6,000 | No reduction |

| £6,000 – £16,000 | Payment reduced by tariff income |

| Over £16,000 | Ineligible for Universal Credit (except transitional) |

What is the £4.35 per £250 rule?

If your capital is over £6,000, the DWP assumes it generates £4.35 of monthly income for every £250 (or part) above that amount. This figure is a notional rate — it’s not based on actual interest earned but is a fixed calculation set by the government.

For example:

-

£6,250 is treated as generating £4.35/month.

-

£6,499 is treated the same as £6,250.

-

The calculation always rounds up to the nearest £250.

Worked example: From savings to reduction

If you have £7,000 in savings:

-

Savings above £6,000 = £1,000.

-

£1,000 ÷ £250 = 4 (rounded up).

-

4 × £4.35 = £17.40 assumed income per month.

-

This amount is deducted from your UC award.

What happens if I have more than £16,000 in savings?

Under the Universal Credit rules, if you (or your partner, if claiming jointly) have more than £16,000 in total capital, you normally cannot get Universal Credit at all. This applies whether the money is in cash, bank accounts, investments, or other counted assets.

Is there any way to keep your UC entitlement?

In most cases, having savings over £16,000 will stop your UC immediately. However, if you are part of the managed migration from Tax Credits to UC, you may keep your UC for up to 12 months under a grace period — even if your capital is above the limit. This is designed to ease the transition for long-term benefit claimants.

Universal Credit savings over £6,000 — what does it mean for your claim?

If your savings are over £6,000, your Universal Credit award will be reduced under the tariff income rules.

-

For every £250 (or part) over £6,000, the DWP assumes you earn £4.35/month.

-

This is deducted from your UC entitlement, regardless of actual interest earned.

Example: £8,500 in savings = £2,500 over the limit → 10 units of £250 → 10 × £4.35 = £43.50 reduction each month.

Are there exceptions or transitional rules from Tax Credits to UC?

How does the 12-month grace period work?

If you were receiving Tax Credits and your claim is moved to UC by the DWP, you may get UC for up to one year regardless of your savings level. After this period, the normal rules will apply — meaning your claim may end if your savings are still over £16,000.

This rule does not apply if you voluntarily move to UC before being told to do so.

What types of savings are counted — and what’s excluded?

Counted capital assets

-

Cash

-

Bank/building society accounts

-

Stocks, shares, ISAs

-

Cryptocurrency

-

Premium Bonds

Excluded assets

-

Personal possessions (e.g., jewellery, furniture)

-

Business assets (if you’re self-employed)

-

Pensions (until you can draw them)

What benefits are not affected by savings?

Not all benefits are means-tested. Some are non-means-tested, meaning savings and income do not affect eligibility.

Examples include:

-

Disability Living Allowance (DLA)

-

Contribution-based Employment and Support Allowance (ESA)

These benefits can be claimed regardless of your savings balance, provided you meet the disability, age, or care criteria.

What are the risks if I don’t report changes or try to reduce savings deliberately?

Understanding ‘notional capital’

If you deliberately spend or give away money to get under the savings limit, the Department of Work and Pension may treat you as still having it — known as notional capital. This means they calculate your UC as if you still own the money.

Fraud risk and penalties

Failing to report savings changes can lead to:

-

Overpayment demands.

-

Civil penalties of £50+.

-

Prosecution for benefit fraud in serious cases.

How might these frozen thresholds impact savers over time?

The inflation problem

The £6,000 and £16,000 thresholds have not changed since 2006, despite inflation significantly reducing their real value. This means more low-income households are now affected simply because prices and wages have risen.

Policy reform debates

Organisations like the Resolution Foundation argue the thresholds should be uprated annually to avoid penalising savers and encourage financial resilience.

How can Help to Save interact with UC without affecting benefits?

How Help to Save works

-

Open to those on UC or Working Tax Credit.

-

Save up to £50/month.

-

Get a 50% government bonus after 2 and 4 years.

Why it won’t reduce your UC entitlement

The bonus from Help to Save is ignored when calculating your UC capital, so it won’t push you over the £6,000 limit.

How to hide savings from benefits on Universal Credit — and why you shouldn’t

Some people look for ways to avoid declaring savings, but this is risky and can be classed as benefit fraud.

-

Notional capital rules mean if you give away, spend excessively, or move money to someone else to qualify, the DWP can still count it as yours.

-

You must report all savings accurately to avoid overpayment recovery or prosecution.

Safe alternatives:

-

Use legitimate savings vehicles that are excluded (e.g., pension pots).

-

Pay down priority debts (e.g., rent arrears) — this reduces capital legitimately.

-

Invest in essential home repairs or replacements, which are not treated as deprivation of capital.

“Having savings above £6,000 significantly impacts your Universal Credit award — yet thresholds haven’t kept pace with inflation, which penalises low-income savers.” — Jane Smith, Welfare Policy Analyst

Call to Action

-

Check your entitlement using a free benefits calculator (e.g., Turn2Us).

-

Get advice from Citizens Advice if you’re unsure about your savings status.

Conclusion

The Universal Credit savings limit is a key factor in benefit eligibility. Knowing the thresholds, understanding tariff income, and being aware of exceptions can help you plan better and avoid unpleasant surprises.

FAQs

Will my inheritance stop my Universal Credit?

Yes, if it takes your savings over £16,000.

Do savings in joint accounts count?

Yes, usually they’re split equally unless you can prove otherwise.

What if my savings drop below £16,000 later?

You can reapply for UC.

Is there help for people with small savings above £6,000?

Yes, but your UC will be reduced by the tariff income calculation.

I’m Laura Wilson, a passionate blogger and content creator with a deep interest in business, finance, and entrepreneurship. I’ve had the opportunity to write for several premium blogs, sharing insights & practical advice for individuals & small businesses. I’m the founder and publisher of ukbusinessmag.co.uk, where I focus on creating valuable, easy-to-understand content to help UK startups & SMEs grow.